Financial Modeling and Analysis in Matlab

Are you interested in gaining a deeper understanding of financial modeling and analysis using Matlab? Whether you’re a finance professional, student, or enthusiast, mastering the use of Matlab for financial modeling can significantly enhance your analytical skills and insights. In this blog post, we will explore the fundamentals of financial modeling and analysis in Matlab, covering everything from building basic models to performing statistical analysis and creating visualizations for financial data. We will also delve into advanced techniques that can elevate your financial modeling capabilities to a new level. So, if you’re ready to take your financial analysis skills to the next level, buckle up as we take a deep dive into the world of financial modeling and analysis in Matlab. By the end of this post, you’ll have a solid foundation to tackle complex financial scenarios with confidence using Matlab. Let’s get started!

Introduction to Financial Modeling in Matlab

Financial modeling in Matlab is a powerful tool for analyzing and predicting the future performance of financial assets. It allows analysts and professionals to create mathematical models that simulate the performance of financial securities and investment portfolios.

With Matlab, users can perform complex calculations, build algorithms, and create simulations to forecast the behavior of stocks, bonds, options, and other financial instruments. This helps in making informed investment decisions and managing financial risks.

Financial modeling in Matlab provides a flexible platform for developing custom models and experimenting with different scenarios. It enables users to test the impact of various variables and assumptions on the valuation and performance of financial assets.

By learning the basics of financial modeling in Matlab, individuals can gain a deeper understanding of financial markets and develop the skills needed to analyze and interpret complex financial data.

Building a Basic Financial Model

When it comes to financial modeling, building a basic model is essential for understanding the financial health of a business. A basic financial model typically includes a company’s income statement, balance sheet, and cash flow statement, which are used to evaluate the performance and financial position of the business.

One of the key steps in building a basic financial model is gathering historical financial data from the company’s financial reports. This includes revenue, expenses, assets, liabilities, and cash flows over a specific period of time, such as the past 3 to 5 years. With this data in hand, you can start to create the foundation of the financial model.

Next, it’s important to make assumptions for future financial performance, including revenue growth rates, expense projections, and capital expenditures. These assumptions will help to forecast the company’s financial position and performance in the upcoming years.

Once the historical data and future assumptions are gathered, the next step is to input this information into a Matlab financial modeling tool to calculate and analyze the company’s financial metrics. This can include metrics such as net income, EBITDA, free cash flow, and financial ratios. These calculations will help to paint a clear picture of the business’s financial health and performance.

Performing Statistical Analysis in Matlab

When it comes to performing statistical analysis in Matlab, there are several powerful tools and functions that can be utilized to gain insights from financial data. One of the key functions for statistical analysis in Matlab is the ‘corr’ function, which calculates the correlation coefficient between two variables. This can be extremely useful for understanding the relationship between different financial metrics and for identifying potential patterns or trends within the data.

Another important aspect of statistical analysis in Matlab is the ability to conduct hypothesis tests, such as t-tests and ANOVA, using the ‘ttest’ and ‘anova’ functions. These tests can help in making inferences about the population parameters based on sample data, which is essential for making informed decisions in the financial industry.

In addition, the ‘fitlm’ function in Matlab can be used for linear regression analysis, allowing users to model the relationship between two or more variables and make predictions based on the regression equation. This is particularly valuable for forecasting financial trends and making investment decisions.

Overall, Matlab provides a comprehensive set of tools for performing statistical analysis in the context of financial modeling, making it a preferred choice for professionals working in the finance industry.

Creating Visualizations for Financial Data in Matlab

When it comes to financial modeling in Matlab, creating visualizations for the data is a crucial step in understanding and interpreting the information. With the use of Matlab‘s powerful visualization tools, such as plot, scatter, and histogram, analysts and researchers are able to represent complex financial data in a more digestible and meaningful way.

Not only does visualizing financial data in Matlab make it easier to identify trends, patterns, and outliers, but it also allows users to communicate their findings more effectively. Whether it’s for internal reporting, client presentations, or academic research, creating compelling visualizations is essential in the realm of financial modeling.

One of the key advantages of using Matlab for creating visualizations is its flexibility and customization options. With the ability to control aspects such as colors, line styles, and plot types, users can tailor their visualizations to best suit their specific data and analysis goals.

Furthermore, by integrating visualizations into Matlab‘s financial modeling workflow, users can gain deeper insights into the data, identify potential risks and opportunities, and ultimately make more informed decisions. Whether it’s stock price movements, portfolio performance, or economic indicators, the power of visualizations in Matlab is undeniable in the world of financial modeling.

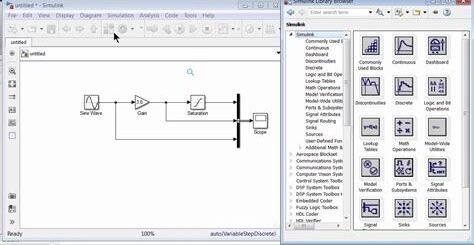

Advanced Techniques for Financial Modeling in Matlab

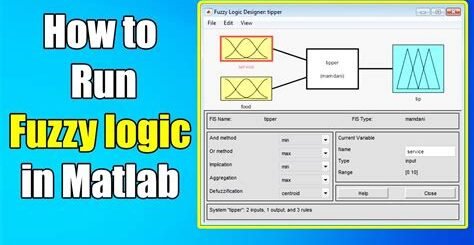

When it comes to financial modeling in Matlab, there are a variety of advanced techniques that can take your analysis to the next level. One of the most powerful features of Matlab is its ability to handle large datasets and perform complex calculations with ease. This makes it an ideal tool for advanced financial modeling tasks such as risk analysis, option pricing, and portfolio optimization.

One of the key advanced techniques in financial modeling is the use of Monte Carlo simulations. This approach involves running multiple simulations with random variables to model the behavior of financial instruments or portfolios. Matlab’s efficient processing power allows for the rapid generation of thousands of scenarios, providing valuable insight into the potential outcomes of various investment strategies.

Another advanced technique is the implementation of stochastic calculus for modeling asset prices and interest rates. By incorporating stochastic processes into your financial models, you can capture the dynamic nature of market movements and make more accurate predictions about future prices and returns. Matlab’s built-in functions for handling stochastic processes make it a robust platform for advanced financial modeling.

Furthermore, Matlab offers powerful tools for time series analysis, allowing you to model and forecast the behavior of financial data over time. This includes techniques such as autoregressive integrated moving average (ARIMA) modeling and vector autoregression (VAR), which are essential for understanding the interdependencies and dynamics of financial time series. These advanced methods can provide valuable insights for investment decision-making and risk management.